Fundamentals of Investing in Thailand

Are you contemplating on investing in Thailand by starting a business? If so, here are some of the legal basics—a rough business guide in Thailand—you need to know as potential foreign investor:

1. Company Registration and Work Permits

Foreign investors are generally allowed to start a business in Thailand, which would be subject to the Foreign Business Act B.E. 2542 (A.D. 1999) (FBA)[1]. The FBA regulates the types of businesses that foreign investors could conduct. It also provides the licensing requirements for all the different types of businesses that foreign investors could be interested in.

Before we proceed, foreign investors are legally known as aliens (or foreigners). An alien could be: (1) A non-Thai natural person, (2) A legal person not Incorporated in Thailand, (3) A legal person incorporated in Thailand with at least half of its company shares held by persons under the two previously mentioned categories, or (4) A partnership where the managing partner is a non-Thai natural person[2].

The FBA has prescribed categories of restricted businesses into three schedules. Schedule 1 covers businesses that are strictly prohibited to aliens; Schedule 2 covers businesses that are prohibited to aliens unless they receive permission to operate from the Cabinet, and Schedule 3 covers businesses that are prohibited to aliens unless permission is granted by the Director-General of the Department of Business Development (DBD)[3]. You can find out more about these restrictions by clicking on this link. Issues with company registration and work permits can easily be sorted out by consulting and contacting a law firm in Thailand.

2. Intellectual Property

Intellectual property is generally classified into marks (the unique way of differentiating from one product/service/certification to another), patents (innovations that hold exclusive rights for use), and copyrights (apply to literary, artistic, dramatic, musical, audio-visual, cinematographic, sound and video broadcasting works, and computer software). The Department of Intellectual Property, Ministry of Commerce, is the one responsible for all matters relating to intellectual property. Issues regarding intellectual property can easily be sorted out by consulting and contacting a law firm in Thailand.

Protection of intellectual property is based on the following Acts[4]:

- Trademark Act B.E. 2534 (A.D. 1991)

- Trademark Act (No. 2) B.E. 2543 (A.D. 2000)

- Patent Act B.E. 2522 (A.D. 2000)

- Patent Act (No. 2) B.E. 2535 (A.D. 1992)

- Patent Act (No. 3) B.E. 2542 (A.D. 1999)

- Copyright Act B.E. 2521 (A.D. 1978)

- Copyright Act B.E. 2537 (A.D. 1994)

- Civil and Commercial Code

- Penal Code

- Consumer Protection Act

3. Litigation

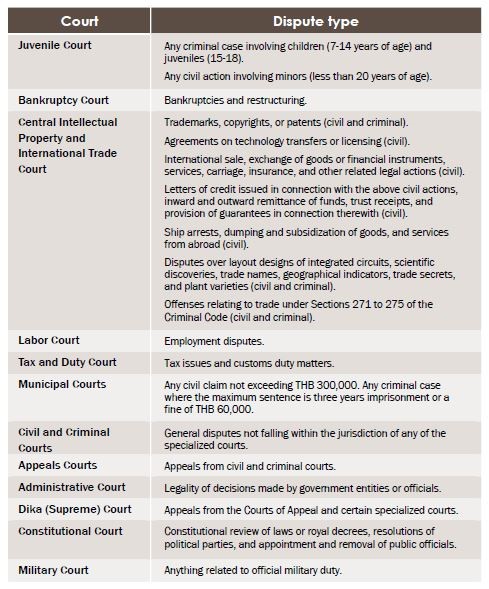

Source: INVESTING IN THAILAND. (2014). In THAILAND Legal Basics (p. 146). Tilleke & Gibbins.

Above is the basic overview of the courts and the types of matters different courts have jurisdiction over. Do remember that issues regarding litigation can easily be sorted out by consulting and contacting a law firm in Thailand.

4. Taxation

Personal Income Tax

A resident of Thailand is subject to tax on all assessable income derived from sources within the country, and all assessable income derived from foreign sources to the extent that it is brought into Thailand in the year in which income is received.[5]

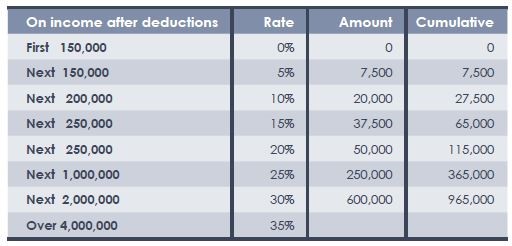

The tax due is computed in the net assessable income (income after deduction of expenses and allowances) at progressive rates ranging from 10% to 35%. Below is a table to summarize.

Source: INVESTING IN THAILAND. (2014). In THAILAND Legal Basics (p. 77). Tilleke & Gibbins.

Corporate Income Tax

Corporate Income Tax (CIT) is a direct tax levied on a juristic company or partnership carrying on business in Thailand or not carrying on business in Thailand but deriving certain types of income from Thailand[6]. To learn more about Corporate Income Tax for company incorporation and foreign investment in Thailand, click here. Issues with regard to Corporate Income Tax can easily be sorted out by consulting and contacting a law firm in Thailand.

Are you looking for a law firm you can trust with legal service to kick-starting your investment in Thailand?

Why not SBC Interlaw? Our firm has a long history in Thailand with a wealth of experience in legal counsel in dispute resolution and litigation. SBC is a law company an innovative firm and highly committed with passion to our clients. Building on our core values of integrity, initiative and inquisitiveness, we have forged long rewarding relationships with our clients.

Our firm is based on a commitment to ensuring quality customer service to our clients. Our background in international law and international business law has given our company a competitive edge in addressing foreign clients’ concerns, and it is this commitment to client services that serves as the backbone of the firm. Do drop us an email or simply give us a call if you would like to know how SBC’s Asian lawyers can be of service to you by clicking here.

_______________________

[1] INVESTING IN THAILAND. (2014). In THAILAND Legal Basics (p. 2). Tilleke & Gibbins.

[2] Ratprasatporn, P., & Thienpreecha, K. (2002). FOREIGN INVESTMENT IN THAILAND: REVIEW OF THE CURRENT LEGISLATIVE REGIME. Retrieved May 6, 2015, from this work.

[3] INVESTING IN THAILAND. (2014). In THAILAND Legal Basics (p. 3,4). Tilleke & Gibbins.

[4] INVESTING IN THAILAND. (2014). In THAILAND Legal Basics (p. 147). Tilleke & Gibbins.

[5] INVESTING IN THAILAND. (2014). In THAILAND Legal Basics (p. 77). Tilleke & Gibbins.

[6] Corporate Income Tax. (n.d.). Retrieved May 6, 2015, from this work.